Tesla's Energy Business: Faster-Growing and Now More Profitable Than Its Auto Business

time:2023-11-16 09:04:13 Views:0 author:Jinan Freakin Power Ltd.

In Q3, Tesla's energy generation and storage segment's revenue surged 40% year over year -- and its gross profit grew an even more torrid 266%.On Wednesday, electric vehicle (EV) pioneer Tesla (TSLA 2.29%) released third-quarter 2023 results that disappointed investors, who drove shares down 9.3% on Thursday. That reaction stemmed from a few factors: revenue and earnings missing Wall Street's expectations, the gross margin's continued decline resulting from the company's ongoing vehicle price cuts, and CEO Elon Musk's cautious tone on the earnings call.

But there was an electrifying bright spot in Tesla's Q3 report: the performance of its energy generation and storage segment. This business has two parts -- energy storage and solar. The former's products include lithium-ion-battery-based stationary energy storage systems (Powerwall for residential, Powerpack for businesses, and Megapack for utilities and large-scale commercial projects), while solar's products include solar panels and solar roof tiles.

Let's dive into this business, which isn't getting enough attention.

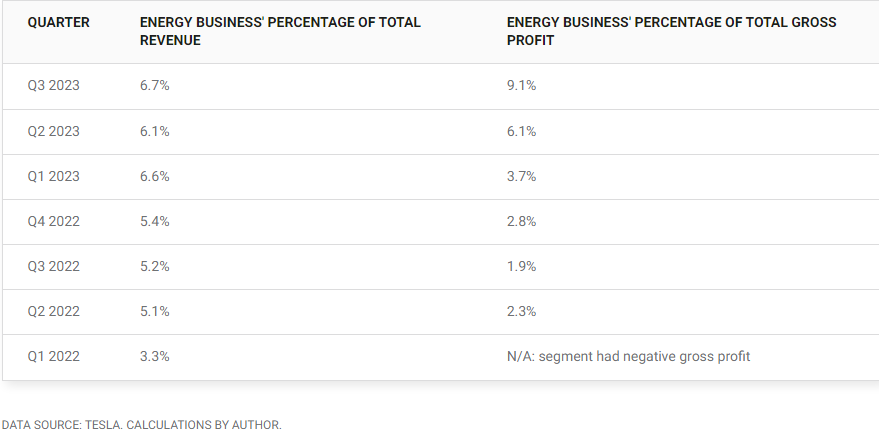

Tesla's energy business now accounts for nearly 7% of its total revenue and more than 9% of its gross profit 2022 quarters.There are two reasons Tesla's energy segment's percentage of the company's total revenue and earnings have been growing more quickly in recent quarters. First, its revenue and gross profit have been growing in absolute, or dollar, terms. Second, the its core auto segment's revenue growth has slowed and its profitability has declined.

Tesla's "services and other" segment is not included in the charts because this article's focus is the energy segment. Moreover, while the service business is profitable, it has little effect on the company's overall profits. In Q3, it contributed 3.1% to gross profit, while the energy business contributed nearly three times that percentage. If all goes well with Tesla's plans, the services business should eventually contribute more to the company's profits. As one example, the company's paid Supercharging business, which is profitable according to the Q3 release, is poised to grow because other automakers have been adopting Tesla's charging connector system, the North American Charging Standard (NACS).